Selling your mineral rights is a major financial decision, but it can also expose you to scams. One wrong move and you could lose thousands.

Imagine receiving an unsolicited offer in the mail with a tempting check inside. Sounds like easy money, right? But when you try to cash it, the terms buried in fine print transfer full ownership of your mineral rights. Just like that, you’re out.

Sadly, stories like these happen more often than you think.

Knowing how to avoid mineral rights scams and what red flags to watch for is your best protection. Here’s how to sell smart and safe.

What are the most common mineral rights scams?

Fake buyers, lowball offers, and hidden contract terms are the biggest traps.

Scammers prey on landowners who don’t know the real value of their mineral rights. They use confusing paperwork, misleading payments, or high-pressure tactics to lock you into deals that heavily favor them.

Be aware of:

- Unsolicited mail offers with checks included

- Buyers who won’t explain their valuation

- Verbal promises not backed by contracts

- High-pressure closing tactics (“Offer expires tomorrow!”)

Typical scam examples:

Here are common scam types and what typically happens in each case:

Scam Type | What Happens |

Mail-In Check Trap | Cashing a check binds you to a sale via hidden contract terms |

Fake Appraisals | Inflated or fake valuations to pressure you into signing |

Wire Fraud in Transactions | Posing as title agents or buyers to intercept closing funds |

Lease Disguised as a Sale | You think you’re selling, but it’s just a lease with no upside |

How can I tell if a buyer is legitimate?

A real mineral buyer will be transparent, responsive, and professional.

Reputable companies take time to answer your questions, provide clear documentation, and don’t rush you. If something feels rushed or vague, it’s a red flag.

Key signs of a legit buyer:

- Full disclosure of terms and payment timelines

- Clear proof of funds or financial backing

- Professional communication with proper documentation

What red flags should I watch for in offers?

If it’s too good to be true, or too fast, it usually is.

Scam offers often look official, with fast timelines and confusing clauses buried in legal language. Learn to read between the lines.

Top red flags:

- “Cash today” with no inspection or title check

- Unclear ownership transfer language

- Missing deadlines or vague dates

- No written explanation of how they calculated your mineral value

Red Flag Comparison:

Offer Type | Legit Buyer | Scam Buyer |

Time to Close | 30–60 days, due diligence included | 1–2 days, no checks or reviews |

Contract Language | Clear, simple, and reviewed by the legal team | Vague, overly technical, confusing |

Buyer Response | Answers your questions patiently | Dodges or ignores your concerns |

Why should I get a third-party valuation first?

It helps you avoid getting underpaid or misled.

Without a neutral valuation, you’re guessing at the worth of your mineral rights. Scammers often take advantage of this and make low offers.

Benefits of a third-party valuation:

- Real market value benchmark

- Gives you negotiation power

- Exposes underhanded pricing tactics

- Protects you from one-sided deals

You can work with professional evaluators or companies like Paint Rock Royalty that offer free assessments backed by experience and data.

Can I protect myself with the contract language?

Yes, but only if you read and understand everything before signing.

Contracts are where most fraud hides. Even one vague sentence can cost you ownership or future royalties. Never sign anything without reading and asking questions.

Contract protection tips:

- Have an attorney review all contracts

- Insist on clear timelines and payment terms

- Avoid “blanket conveyance” language

- Clarify what happens if the deal doesn't close or is canceled

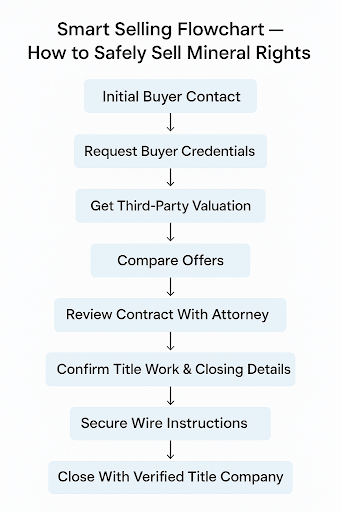

What steps should I follow to avoid fraud when selling?

Follow a verified process from offer to closing to stay protected.

Stick to a smart selling flow, from initial offer to the final transfer, to avoid being caught off guard.

Where should I go if I suspect a scam?

Report fraud and speak to a trusted mineral rights professional right away.

If you believe you’ve been targeted, don’t ignore it. The longer you wait, the harder it may be to recover.

What to do next:

- Stop communication with the buyer immediately

- Do not sign or cash anything further

- Report the scam to your local state oil and gas commission

- Reach out to a legitimate buyer like Paint Rock Royalty for help

Contact our team today to review your situation with no pressure.

What makes Paint Rock Royalty a trusted buyer?

We’re transparent, experienced, and focused on your benefit, not just the sale.

Paint Rock Royalty has helped thousands of mineral owners across Texas and beyond. We believe in clear communication, honest pricing, and long-term relationships.

We operate in key areas with proven reserves. See our areas of interest to find out if your land qualifies.

Why is understanding land development important when selling mineral rights?

Because future development potential increases your land’s value.

Buyers know this and may lowball your offer to profit later. You should understand how land development and oil/gas exploration affect pricing.

How Land Development Increases Mineral Value

Understanding how development impacts your mineral rights can help you make smarter decisions before selling.

- Land with Surface Minerals You own property that may contain oil, gas, or other valuable minerals.

- Exploration by Oil/Gas Company Exploration companies assess your land’s mineral potential using surveys and technical data.

- Drilling or Infrastructure Added Physical development, like drilling wells or laying pipelines, begins.

- Proven Reserves Identified Once resources are confirmed, your mineral rights become more valuable.

- Mineral Value Multiplies With reserves proven and production potential clear, your property’s mineral value can increase substantially.

Timing matters. Selling too early could mean missing out on the true worth of your assets.

Protect Yourself When Selling Mineral Rights

Selling your mineral rights doesn’t have to be risky, but it does require awareness.

Take your time, verify everything, and never rush. A real buyer will work with your pace, not against it.

If you want a clear, honest evaluation from professionals who have your best interests in mind, reach out to Paint Rock Royalty. We’re here to make sure you sell smart, not scared.

Sell Smart—Stay Safe with Paint Rock Royalty

Ready to sell your mineral rights, but not fall for a scam?

At Paint Rock Royalty, we put honesty first. Our team gives you real numbers, clear paperwork, and patient support every step of the way. No fast talk, no tricks, just fair offers and experience you can count on.

Get in touch with us today for a free, no-pressure consultation. Whether you’re ready to sell or just exploring your options, we’ll help you do it the smart, safe way.

Frequently Asked Questions

What’s the biggest red flag in a mineral rights sale?

Any buyer who offers cash fast without title checks or a contract review is a red flag. Always verify who you’re dealing with.

Can I get scammed by cashing a check I received in the mail?

Yes. Many checks are binding agreements once cashed, legally transferring your mineral rights without further notice.

How do I make sure I’m getting a fair price?

Get a third-party valuation and compare offers. Companies like Paint Rock Royalty provide free evaluations with real market data.

Are all unsolicited offers scams?

Not always, but most are low offers or contain confusing terms. Always investigate thoroughly before engaging.

Is it safe to sell mineral rights online?

It can be safe if done through a verified, reputable company. Avoid sites or buyers with no track record, reviews, or contact information.