When you receive a document claiming to show your rightful share of oil or gas revenues, the last thing you want is to be shortchanged. That document is often called a division order. But many people don’t know how to read it, what each piece means, or how errors creep in. In this post, I’ll walk you through how to read a division order, show examples, warn about common pitfalls, and help you check your royalty calculations.

You’ll also find links to our selling mineral rights service or how it works pages if you prefer an easier exit strategy than navigating the mess yourself.

Let’s get started.

What is a division order

A division order is a legal document used in the oil and gas industry (and mineral leasing) that shows who owns how much of a producing well or mineral interest. According to industry guidelines, a division order identifies ownership and establishes the terms for distributing royalties or production proceeds.

You must understand one thing right away: signing a division order is not mandatory in many cases, but you often won’t get paid until you return it.

A few key items in the division order:

- Name of the well or producing unit

- Your decimal interest (your share of production or proceeds)

- Effective date (when your payments start)

- Any conditions or deductions

- Often, a W-9 or tax form is attached

Understanding it is essential to make sure you don’t accept an unfair share.

Why reading it carefully matters and what “shortchanged” means

If you just glance, sign, and return, you might miss:

- Errors in your decimal share

- Deductions or withholdings not in your lease

- Mistakes in the way acreage or interest is allocated

- Conflicts in ownership or title

- Multiple division orders from different payors (if part of production is sold by different entities)

Getting shortchanged means you may receive less royalty than you deserve. By checking your division order, you protect yourself.

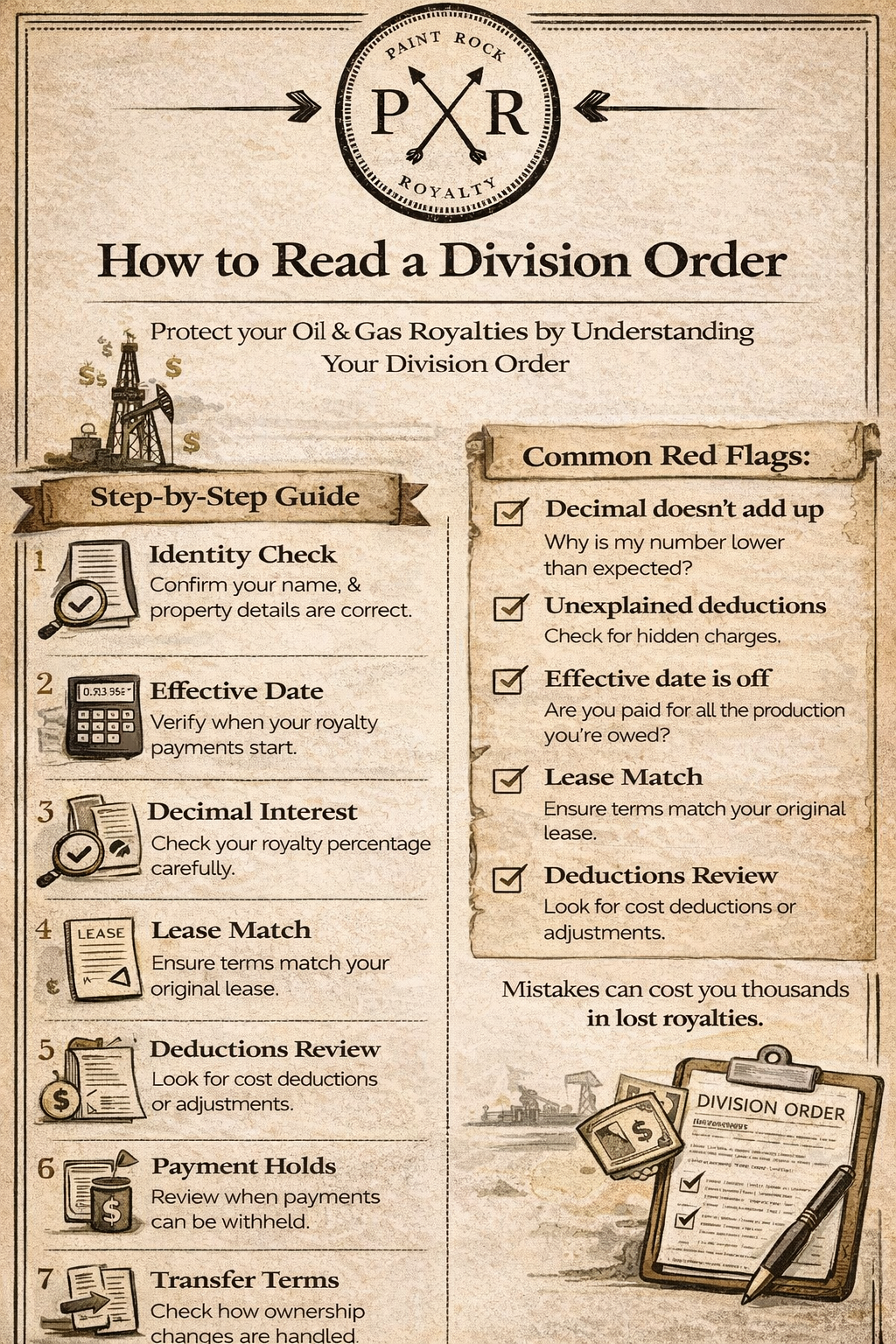

How to read a division order, step by step

I’ll break this into steps you can follow. Think of it like reading a contract, but simpler.

Step 1: Confirm your identity and property description

Check that your name, address, and the legal description (tract, lot, section) match your records. If there is a mismatch, raise the question right away.

Step 2: Check the decimal interest

This is likely the heart of the document. The decimal interest is your share of the production or proceeds from the well.

- The decimal is often based on your acreage, your royalty rate (as in your lease), and how many acres in the producing “unit” or pooled area you’re part of.

- For example:

Decimal=Your net mineral acres×Your royalty rateTotal unit acres\text{Decimal} = \frac{\text{Your net mineral acres} \times \text{Your royalty rate}}{\text{Total unit acres}} Decimal=Total unit acresYour net mineral acres×Your royalty rate - In horizontal or cross-unit wells, sometimes the operator will allocate production by perforated lateral length or by proportional methods.

If the decimal on your division order doesn’t match what your own calculation gives, you should ask for an explanation.

Step 3: Look for deductions, adjustments, or carve-outs

Sometimes a division order may include language that reduces your share because of:

- Nonparticipating royalty interests (NPRI) carved out by someone else

- Overriding royalties

- Post-production costs

- “Gross proceeds” vs “net proceeds” terminology

Make sure any deduction is spelled out and that it matches your lease.

Step 4: Check effective dates and timing

The division order should state when your entitlement begins. If the well started producing before that date, make sure you’re not excluded from earlier production.

Also, check whether payments are monthly, quarterly, and what the minimum threshold is before payment is triggered.

Step 5: Notice of title change or transfers

A division order often requires that you notify the issuer if your ownership changes. If you sell or transfer your interest, that needs updating.

Step 6: Look for withholding or company rights

It may have clauses saying the issuing company can withhold payment if there is a title dispute, or even require you to reimburse them if payment was mistakenly made to someone else.

Step 7: Compare with your lease or ownership documents

Your lease or mineral deed is your baseline. The division order cannot override what your lease says unless you explicitly agreed. If something in the division order conflicts with your lease, you must address that.

Step 8: Don’t rush signing if uncertain

If you don’t understand something, stop. Call the division order analyst, talk to the operator, or consult a mineral rights attorney. It’s okay to ask how they arrived at the decimal or for supporting documents, such as a unit plat or pooling order.

Guide to read a division order

Common division order mistakes (And red flags)

Here are some mistakes people make (or that operators sometimes sneak in):

Mistake / Red Flag | What It Means | What to Do |

Decimal doesn’t match your calculation | They may have used the wrong acreage, unit size, or royalty rate | Ask for a breakdown and verify against your records |

Deductions not spelled out | You may lose money without knowing why | Demand clarity and matching lease language |

Multiple division orders for the same well | Part of the production may be sold by different parties | Confirm total adds up across payors |

Effective date later than production start | You may lose prior production dollars | Verify actual production timeline |

The withholding clause is too vague | They may hold money indefinitely | Press for clear conditions under which they can withhold |

Assignment or transfer clause lacking | If you sell your interest later, complications may arise | Insist transfer language be clean and clear |

Sample calculation and explanation

Let’s walk through a simplified example (based on real methods used in the industry) to see how your decimal could be derived.

Suppose:

- Your tract: 100 acres

- You own 50% of the mineral rights (others own the rest)

- Your lease gives you a 1/5 (20%) royalty

- The producing unit is 640 acres

Your net mineral acres (NMA) = 100 × 50% = 50 acres

Your share = NMA × royalty rate = 50 × 20% = 10 “effective acres”

Divide by unit acres: 10 / 640 = 0.015625 decimal interest

Now, suppose the well is horizontal and perforations are split across two unit zones, and your share in zone A is 60% of the perforations. So your decimal may be further multiplied by 60%. If that gives 0.009375, that should match your division order decimal.

If your division order says 0.0085, you need to ask: Why is mine lower? What adjustments or deductions were made?

Tips you can use immediately

- Always recompute your decimal independently before signing

- Ask for supporting documents (unit plat, pooling orders, well test data)

- Never sign if you disagree, withhold until clarified

- Keep your title/ownership documents handy when reviewing

- Maintain a clear audit trail (dates, communications)

If you prefer not to handle all that detail, explore our selling mineral rights option; it may simplify your life.

Summary (What you must never miss)

- Confirm identity and description

- Recompute the decimal interest

- Scrutinize deductions, carve-outs, and adjustments

- Verify effective dates

- Maintain transfer/notice clarity

- Resist pressure to sign before clarification

Final thoughts on reading a division order

Understanding how to read a division order isn’t just paperwork; it’s protecting what’s rightfully yours. Every decimal, clause, and deduction tells part of your ownership story. Whether you’re confirming your share, checking for errors, or ensuring fair royalty payment calculation, knowing how to read your division order puts control back in your hands.

If you ever feel uncertain, let the experts at Paint Rock Royalty step in. Our team simplifies complex oil and gas ownership documentation, reviews division orders, and ensures you’re never shortchanged.

Contact Paint Rock Royalty today to review your division order or learn more about maximizing your mineral rights’ value.

Frequently Asked Questions

What does “read a division order” really mean?

To read a division order means to analyze every part of that document, the property description, decimal interest, deductions, and effective dates, to ensure it matches your lease and ownership records.

What is “division order explained” in simpler terms?

“Division order explained” means we break down how that document works, what each term means, and how your share is calculated so you understand it fully.

How is royalty payment calculation used in division orders?

Royalty payment calculation is the method by which they determine your portion: your acreage, your royalty rate, unit size, adjustments, and then compute your decimal interest.

What are common division order mistakes to avoid?

Common mistakes include wrong decimals, hidden deductions, mismatched effective dates, vague withholding clauses, and multiple division orders without coherence.

Can I refuse to sign a division order and still be paid?

Yes, in many jurisdictions, you can refuse to sign until the terms are correct, though payment may be withheld until you do. Always demand clarity first.