If you own mineral rights, you probably already know that royalty checks can feel unpredictable. One month, the payment looks solid. Next, it’s surprisingly thin. Why? The answer usually ties back to one major factor: oil prices impact royalties more than most mineral owners realize.

In Texas, where oil plays a massive role in local economies, small changes in the global market can ripple through to your mailbox. But how exactly does this happen, and what can you do about it? Let’s break it down in easy language.

Why Oil Prices Impact Royalties

Royalty checks are a share of production revenue. That means they aren’t fixed like rent. They’re tied to the value of the oil or gas being sold. If oil sells for $70 a barrel, your cut looks very different than if it sells for $90.

Think of it this way: your interest isn’t in barrels, it’s in dollars. When the price of each barrel rises, your check grows. When the price falls, the check shrinks.

Oil Market Volatility and Mineral Rights

Energy markets are notoriously unpredictable. Global politics, natural disasters, supply chain problems, or even weather in the Gulf of Mexico can shift prices overnight. That’s what people mean by oil market volatility and mineral rights.

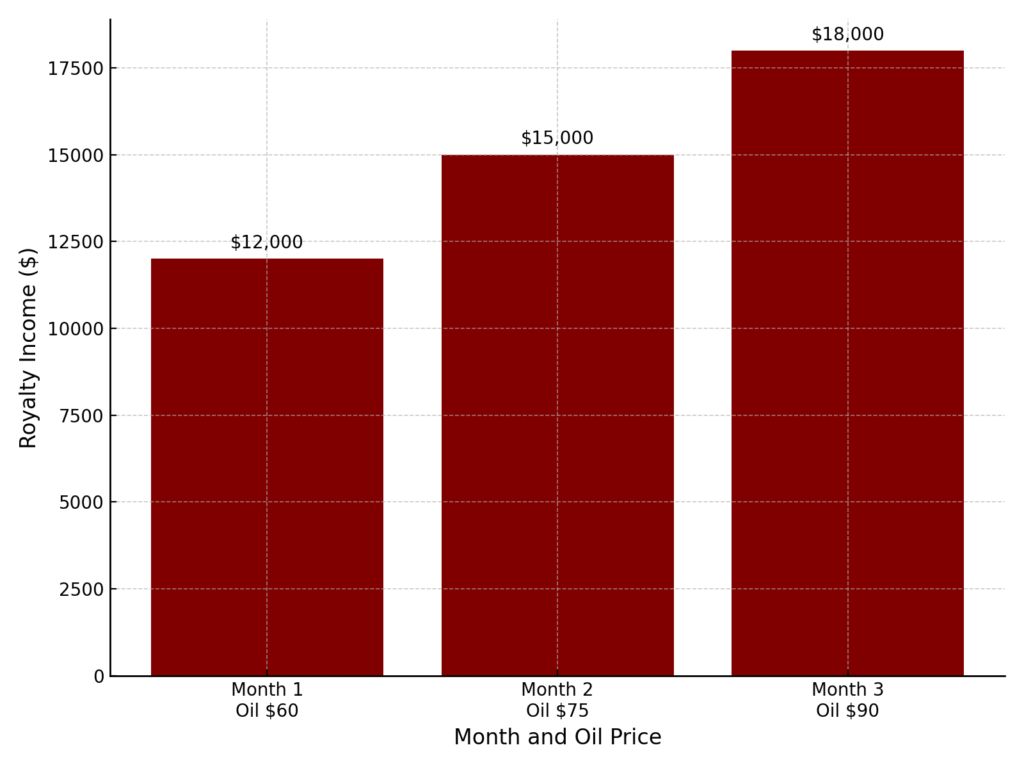

For example:

| Oil Price (per barrel) | Production (per month) | Owner’s Share (at 20%) | Royalty Income |

| $60 | 1,000 barrels | 200 barrels value | $12,000 |

| $75 | 1,000 barrels | 200 barrels value | $15,000 |

| $90 | 1,000 barrels | 200 barrels value | $18,000 |

That swing from $60 to $90 per barrel is the difference between a decent check and a life-changing one.

Texas Royalty Check Fluctuations Example

How Oil Prices Affect Royalty Income in Texas

In Texas, royalty owners experience these ups and downs more than most. Why? Because the state’s production is vast, and contracts often tie payouts directly to market sales.

Many mineral owners are shocked when they learn that their neighbor’s check can look different from theirs, even if the wells are close by. Factors like lease terms, operator deductions, and production timing all mix with how oil prices affect royalty income.

If oil drops in global markets, your Texas royalty check can dip before you even hear the news on TV.

Commodity Price Swings and Royalties: The Reality

It’s tempting to think of royalties as passive income that stays stable. But in truth, they act more like stock dividends. Commodity price swings royalties in real time.

Imagine you count on $3,000 a month from your mineral interests. Suddenly, oil prices fall by 25%. Your royalty drops to $2,250 with no warning. The opposite is also true: a price surge can make a check arrive that feels like a bonus.

The lesson? Planning around steady royalty income is risky unless you prepare for volatility.

Texas Royalty Check Fluctuations: Stories from Owners

We’ve seen it firsthand. One mineral owner told us how her check in Midland County went from $5,400 to just over $2,800 in a matter of two months. Nothing changed on her land. The wells didn’t shut down. The only difference? A price dip triggered by global market news.

Another family in the Permian Basin saw the opposite. They received a check nearly double what they expected after OPEC tightened supply. Their operator had locked in sales at the higher price, and their mailbox reflected it almost immediately.

These Texas royalty check fluctuations are part of the experience. They remind owners that while oil income can be rewarding, it is not predictable without understanding the market.

Can One Price Swing Really Change Checks Overnight?

The short answer is yes. When oil prices move, operators adjust sales quickly. Contracts may tie directly to the daily or monthly market index. That means if oil jumps by 10 dollars per barrel, your next royalty check can feel like a lottery ticket.

But it works both ways. A sudden drop can make checks shrink in the blink of an eye. This is why many mineral owners keep a close eye on global oil news even if they’ve never worked in the industry.

What Mineral Owners Can Do

You can’t control global oil markets, but you can take steps to protect yourself.

- Track the market: Following price indexes can give you a heads-up before your check changes.

- Understand your lease: Some contracts allow more deductions than others. Knowing what’s written can help explain fluctuations.

- Get a professional opinion: Companies like Paint Rock Royalty offer guidance if you’re considering selling mineral rights or simply want to understand your options.

- Plan conservatively: Budget for the low months so that high months feel like bonuses instead of bailouts.

Why Some Owners Sell Their Mineral Rights

Some owners decide that the uncertainty isn’t worth the stress. They choose to sell their rights for a lump sum. That way, they avoid the roller coaster of oil market volatility and mineral rights.

Selling isn’t for everyone. But if your checks are small or unpredictable, it might make sense to explore what your minerals are worth. A lump sum can help pay off debt, secure retirement, or invest in more stable opportunities.

You can learn more about that process on our mineral rights selling page.

Stay Ahead of Royalty Fluctuations

Oil prices will always rise and fall. The key is understanding how those shifts connect directly to your income. If you’re a mineral owner in Texas, your royalty checks will reflect the market almost immediately.

By knowing why oil prices impact royalties, planning, and exploring your options, you can turn uncertainty into informed decisions.

Ready to take control of your mineral rights income? Contact Paint Rock Royalty today to get a clear picture of your royalty potential and explore whether selling or holding is the best choice for you.

FAQs

1. Why do my Texas royalty checks change every month?

They reflect oil and gas sales, which are tied to constantly shifting market prices.

2. How often are royalty payments made?

Most operators pay monthly, but some issue checks quarterly depending on production.

3. Can oil market volatility affect small mineral owners, too?

Yes, even small interests feel the effects of swings in oil and gas prices.

4. Should I sell my mineral rights if my checks are unpredictable?

It depends on your goals. Some prefer steady lump sums over uncertain future income.

5. How do oil prices impact royalties differently from production levels?

Production levels control the volume sold. Prices determine the value. Both matter, but prices often have the bigger day-to-day impact.