When a letter arrives in the mail or your phone rings with someone saying they want to buy your mineral rights, the pitch usually sounds simple. “We’ll give you fast cash today for your minerals.” At first, it feels like a blessing. Money right now. No waiting. No uncertainty. But here’s the problem: cash offers for mineral rights often tell only part of the story, and what gets left out can cost you far more in the long run.

That “too good to be true” feeling? It usually is. Let’s break down why these offers rarely reflect the true value of mineral rights, the risks that come with selling royalties for cash too quickly, and how to spot a fair offer from a lowball one.

The truth behind cash offers for mineral rights

Companies that make these quick offers are not in the business of charity. They’re in the business of profit. Their goal is to buy low and sell high, often to investors or operators who know the mineral market far better than most individual owners.

A cash offer can look attractive when bills are stacking up or retirement is on the horizon. But think of it like trading in your car at a dealership. The dealer needs to leave room to make money, so you’ll never get the actual market value. With minerals, the stakes are far higher.

Why quick sales often mean lowball mineral offers

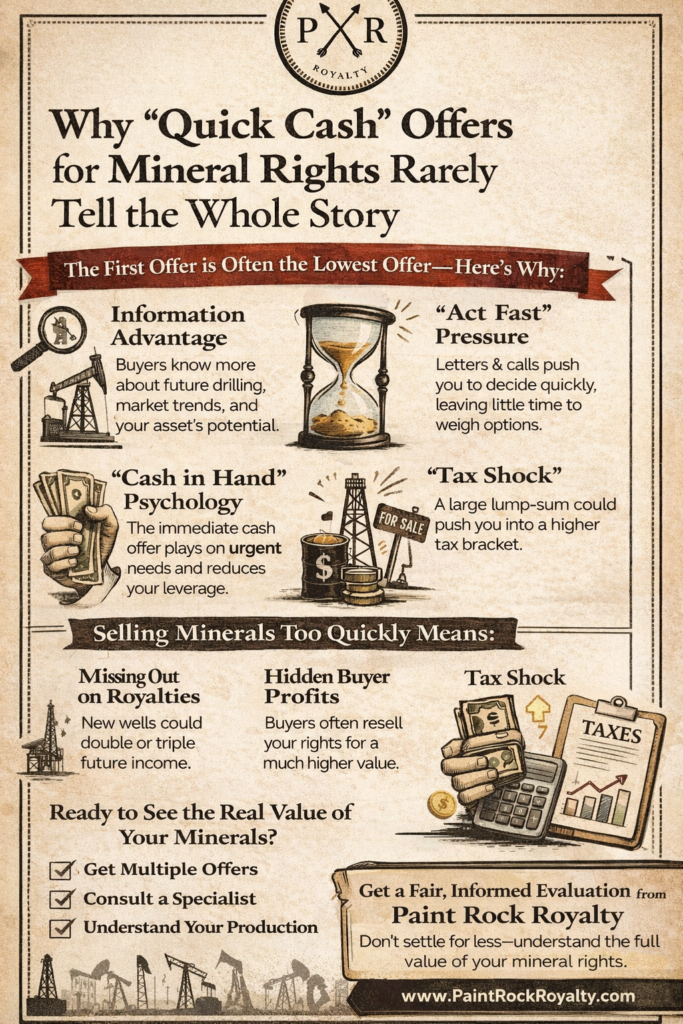

It’s important to understand why so many mineral owners receive what feel like lowball mineral offers. Here are the biggest reasons:

- Information Advantage

The buyer usually knows far more about current drilling activity, production potential, and operator plans. They rely on this knowledge gap to make their offers seem generous. - Pressure of Time

Many offers come with “act fast” language. That’s intentional. The less time you take to research, the more likely you’ll accept without questioning. - Market Fluctuations

Oil and gas prices move constantly. Buyers hedge their risk by offering less than what minerals are likely worth under future price scenarios. - Cash in Hand Psychology

The offer plays on immediate need. It feels secure compared to waiting for royalty checks or an unknown future value.

The true value of mineral rights

Mineral rights are long-term assets. They don’t expire like a paycheck. Wells can produce for decades, and new wells can be drilled years after the first one. If you sell today for a lump sum, you’re trading away not just current royalties but also future potential you may not even know exists.

For example, if you’re receiving modest royalties now, an operator may already have permits for additional wells. That means your income could double or triple. Yet a cash offer made before those wells come online will never account for that.

This is why it’s crucial to evaluate the true value of mineral rights, not just what someone is willing to pay you today.

The hidden costs of selling too quickly

Selling quickly comes with risks that most owners don’t realize until it’s too late:

- Losing generational wealth

Minerals can be passed down and continue to produce income for children and grandchildren. A quick sale cuts off that legacy. - Missing royalty upside

Oil and gas prices are cyclical. Today’s “slow” check could double in a few years if prices rise. - Tax implications

Lump-sum payments may push you into a higher tax bracket. Royalties spread over time are often more manageable. - Hidden buyer profits

If a company turns around and resells your minerals for double or triple what they paid, that’s profit you could have earned yourself.

How to Avoid Lowball Mineral Offers

Avoiding a bad deal starts with slowing down and asking the right questions. Here’s how to protect yourself:

- Get Multiple Offers

Don’t settle for the first letter that arrives. Compare offers to see the range of valuations. - Understand Your Production

Review your check stubs and operator reports. Know what your wells are producing and what’s planned. - Consult a Specialist

Companies like Paint Rock Royalty help mineral owners evaluate their rights based on data, not pressure tactics. - Ask About Future Drilling

If new wells are planned, your minerals could be worth far more than the cash on the table. - Run the Numbers

Compare the lump sum to your royalty history. If your average annual royalties equal the offer in just a few years, holding may be smarter.

When selling royalties for cash makes sense

Not every quick sale is a bad idea. Life circumstances matter. If you need to pay off debt, cover medical bills, or fund a major purchase, selling part of your minerals for cash can be a smart move. The key is deciding with eyes wide open rather than reacting to pressure.

Some owners even choose a mix: selling a portion of their rights for immediate liquidity while keeping the rest to benefit from long-term royalty income.

Why waiting can double (Or triple) your payout

History shows that mineral owners who resist the first cash offers for mineral rights usually come out ahead. Waiting for additional wells, higher oil prices, or simply shopping around for a fair buyer often results in significantly higher payouts.

A recent example from one of our clients illustrates this well. She received a letter offering $45,000 for her minerals. Instead of rushing, she asked questions, reviewed production reports, and got professional advice. Within months, new drilling began on her acreage, and the updated valuation exceeded $120,000. If she had accepted the first offer, she would have left $75,000 on the table.

How to know if you’re getting the full story

A fair buyer should be transparent. They should answer your questions directly, explain how they arrived at their offer, and provide supporting data. If a buyer avoids details or pressures you to decide quickly, that’s a red flag.

Transparency builds trust. That’s why companies committed to fair deals make sure you fully understand both the risks and the opportunities. If you ever feel like you’re not being told everything, you probably aren’t.

Ready to see the real value of your minerals?

At Paint Rock Royalty, we believe you deserve more than a quick check and half the story. Whether you’re curious about the true value of your mineral rights or simply want an honest second opinion, our team makes sure you get clear answers without the pressure.

Don’t settle for lowball offers. Let’s talk about your minerals, your goals, and what makes sense for you.

Call us today or visit Paint Rock Royalty to start your free evaluation.

Frequently Asked Questions

Are quick cash offers for mineral rights ever fair?

Yes, but only if the buyer provides full transparency, data to back up their valuation, and no pressure to decide immediately.

How can I avoid lowball mineral offers?

Get multiple offers, review your royalty history, and consult with experts before making a decision.

What is the true value of mineral rights?

It depends on current production, future drilling plans, and commodity prices. A professional evaluation is the best way to know.

What are the risks of fast mineral sales?

You could lose future royalties, generational wealth, and face higher taxes, while the buyer profits from your minerals.

Should I sell all my mineral rights or just part of them?

Many owners choose to sell a portion for immediate needs while keeping some rights for long-term income.