Owning mineral rights in Texas can be a real game-changer. Whether you’ve inherited them or purchased them, they can bring steady income. However, many owners overlook one important side, mineral rights tax considerations in Texas. From legal rules to IRS reporting, knowing how taxes work can make the difference between smart wealth management and unexpected bills.

Let’s explore what every mineral rights owner in Texas should know, in plain, practical language.

Understanding Texas Mineral Rights Laws

Before we dive into tax details, it helps to know how Texas mineral rights laws work. In Texas, mineral rights can be separated from surface rights. That means you could own the oil, gas, or minerals beneath the land, even if someone else owns the surface above it.

When you sell or lease these rights, you’re essentially transferring or granting the right to extract minerals for profit. The legal rules protect both parties, but can get tricky fast. That’s why understanding ownership boundaries, lease terms, and tax impacts is so important before signing anything.

Example:

Let’s say you inherited land from a relative in West Texas. You might own both the surface and the mineral rights. But if your family sold surface rights years ago, the current surface owner could still allow drilling under certain lease conditions, even though the minerals still belong to you.

Key Mineral Rights Tax Considerations in Texas

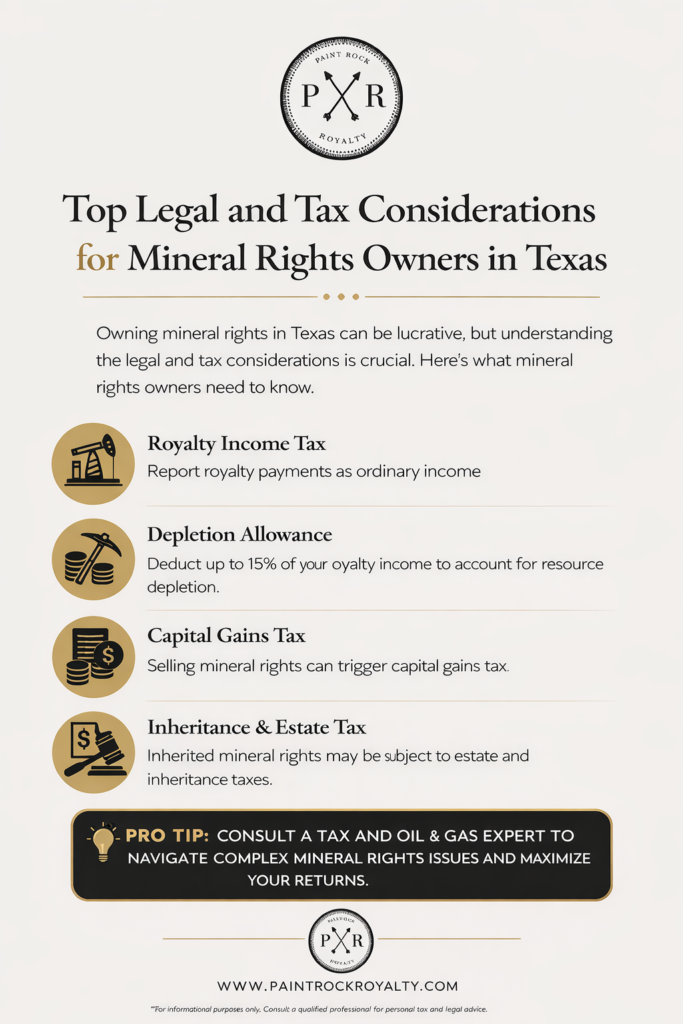

Taxes can catch even experienced landowners off guard. Here are the most important mineral rights tax considerations in Texas to keep in mind.

Tax Category | Description | Key Tip |

Royalty Income Tax | Income earned from producing minerals | Report as ordinary income on your federal tax return |

Depletion Allowance | Deduction for the loss of natural resources | Typically 15% for most owners |

Capital Gains Tax | Applies when you sell mineral rights | Taxed based on holding period |

Property Taxes | Counties may assess value based on reserves | Check local appraisal district records |

Estate & Inheritance Taxes | Applies when rights are inherited | Get a professional valuation at the time of inheritance |

Each of these affects how much you actually take home.

Royalty Income and IRS Reporting

If you lease your mineral rights, you’ll receive royalty payments. The IRS treats these payments as ordinary income. That means you must report them just like any other income source.

However, the good news is you can claim a depletion deduction, which reduces your taxable income. Most small owners qualify for a 15% depletion allowance, a useful tax break that recognizes the natural decline of your resource.

When you sell your rights, the selling mineral rights tax implications depend on how long you’ve owned them.

- Short-term capital gains: If you’ve owned the rights for less than a year, profits are taxed at your regular income rate.

- Long-term capital gains: If you’ve held them longer, you’ll likely pay a lower tax rate.

To determine your gain, subtract your “basis” (what you originally paid or inherited value) from the selling price. For inherited rights, your basis equals the fair market value at the time of inheritance, not the original owner’s cost.

Pro Tip:

Keep every document, deed, appraisal reports, and royalty statements. They’ll help establish your cost basis when filing taxes.

Inheritance of Mineral Rights in Texas

The inheritance of mineral rights in Texas comes with both opportunities and responsibilities. If you’ve inherited mineral rights, you automatically become responsible for paying any related taxes.

You’ll need to file a new deed transferring ownership into your name and update tax records with the county. If you decide to sell, make sure the inherited value is properly appraised. This value becomes your cost basis for future tax calculations, reducing your capital gains tax later.

Example:

If your grandmother’s mineral rights were valued at $100,000 when she passed and you sell them five years later for $150,000, you’d only pay capital gains tax on the $50,000 profit.

Understanding Texas Property Tax on Mineral Rights

Texas counties often assess property taxes on producing mineral rights. The value is based on current production, market prices, and reserve estimates.

If your minerals aren’t currently producing, you might owe little or no tax. But once production starts, expect a tax bill. Always verify your county’s appraisal and don’t hesitate to appeal if values seem inflated.

Common Legal Mistakes Mineral Owners Make

Even experienced owners can make costly errors. Here are a few common ones:

- Not verifying title ownership before signing leases.

- Failing to report royalty income or depletion correctly.

- Ignoring local tax deadlines or missing property tax payments.

- Selling rights without reviewing the capital gains impact.

Professional Help Can Save You Money

Working with experts can turn a confusing tax season into a smooth one. A professional specializing in mineral rights tax considerations in Texas can:

- Review your royalty statements for reporting accuracy.

- Ensure your depletion deductions are calculated correctly.

- Help structure sales for lower capital gains exposure.

- Guide you through estate planning for inherited mineral rights.

Example- Smart Tax Planning in Action

Imagine Lisa, a mineral rights owner in Midland. She inherited her rights and leased them to an operator. Instead of waiting for tax season, she consulted a CPA specializing in oil and gas. Together, they calculated her depletion allowance and adjusted quarterly payments. By year-end, she saved thousands in taxes and had clean, accurate records for future sales.

Smart planning like Lisa’s can make a major difference.

Related Resources

For deeper insights on selling or managing your rights, check out:

And for verified tax information, visit the Texas Comptroller of Public Accounts.

Conclusion

Owning mineral rights in Texas can open exciting financial doors, but the legal and tax details matter. Understanding mineral rights tax considerations in Texas, from royalty income and depletion to inheritance and capital gains, keeps you protected and profitable.

If you’re considering selling, inheriting, or leasing your rights, take time to plan smartly. For personal guidance, explore more insights or contact the experts at Paint Rock Royalty.

Frequently Asked Questions

What are the main mineral rights tax considerations in Texas?

They include income reporting, depletion deductions, capital gains on sales, and county property taxes.

How are royalty payments from mineral rights taxed?

They’re considered ordinary income by the IRS, but you can claim a 15% depletion deduction.

What are the tax implications of selling mineral rights in Texas?

Profits are taxed as capital gains, short or long-term, depending on how long you owned the rights.

How does the inheritance of mineral rights in Texas work?

You’ll need to transfer ownership legally and establish a new cost basis for future tax reporting.

Can I reduce taxes when selling my mineral rights?

Yes, by planning with a CPA and using your fair market value as your basis, you can minimize capital gains.